Investing in America: The Opportunity for Global Buyers

Investing in America has long been a dream for many around the world — whether it’s for financial gain, family relocation, or long-term security. With a stable property market, strong legal protections, and no citizenship requirements for ownership, the U.S. remains one of the most accessible places in the world to buy real estate.

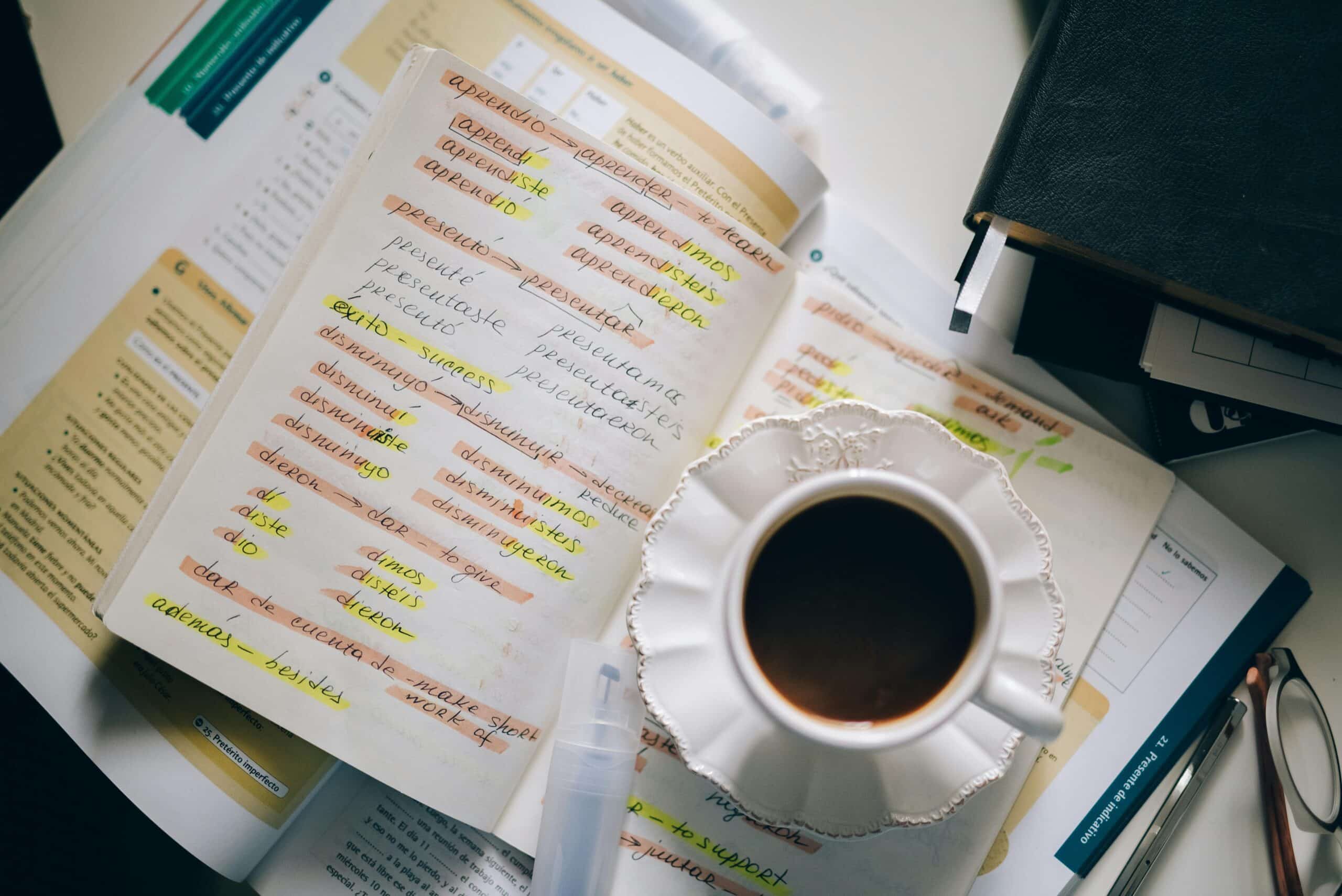

But for non-English speakers, the process comes with its own challenges — particularly when it comes to documentation. From legal contracts to financial records, non-English documents must be translated into English, and in most cases, certified to be accepted by real estate professionals, banks, and government offices.

This guide will walk you through how to prepare yourself and your documents to successfully invest in U.S. property — and how ATA-certified translations from Immi Translating Service can help you every step of the way.

🏠 Why Investing in America Is So Popular

Whether you’re a high-net-worth individual, a first-time investor, or a parent supporting your child’s studies, America’s real estate market offers benefits like:

-

No citizenship or visa requirement to purchase property

-

A wide range of investment options — from apartments to commercial buildings

-

Long-term value growth in stable metropolitan areas

-

Legal protections for property owners

-

Rental income opportunities in top tourist and university cities

Many international buyers use U.S. properties for:

-

Vacation or retirement homes

-

Children studying abroad

-

Passive rental income

-

Green card or EB-5 investment pathways

📄 The Hidden Hurdle: Language and Document Barriers

If you’re not fluent in English, the U.S. property purchase process can feel overwhelming. Contracts, tax forms, financial disclosures, and legal agreements are all in English — and if your documents are in another language, they must be translated and certified.

Failing to provide proper translations can result in:

-

Loan rejections

-

Delays in closing

-

Legal disputes over misunderstood contracts

-

Requests for re-translation at added cost

That’s why certified translation isn’t optional — it’s a core part of the real estate process.

✍️ What Is a Certified Translation and Why Is It Required?

A certified translation includes a formal declaration from the translator or translation company confirming that the translation is complete and accurate. This signed certification is accepted by:

-

Mortgage lenders

-

Title and escrow companies

-

Immigration offices

-

U.S. courts and legal authorities

Immi Translating Service provides ATA-certified translations, which are recognized across the United States for real estate, finance, and legal use. With years of experience, our team ensures your documents are translated with precision and professionalism.

📌 Documents That Require Certified Translation When Investing in America

When purchasing U.S. real estate, foreign buyers often need to translate the following:

Identification & Personal Documents

-

Passport or national ID

-

Birth or marriage certificates (for joint ownership or visa-linked purchases)

Financial Documents

-

Bank statements

-

Foreign income verification

-

Employment contracts or payslips

-

Tax returns or property ownership history

Legal Documents

-

Power of attorney (if someone signs on your behalf)

-

Business registration documents (for corporate buyers)

-

Trust or inheritance paperwork

-

Pre-existing real estate contracts in another language

Even if you’re paying cash, most legal or financial entities will still require these documents in certified English.

📋 Self and Document Preparation: What You Can Do Now

To make your U.S. property purchase smooth and stress-free, start preparing early:

Step 1: Organize Your Non-English Documents

Gather all documents that may be required during financing, legal review, and closing.

Step 2: Contact a Certified Translator

Send your documents to a recognized translation provider like Immi Translating Service. Don’t rely on informal translators or Google Translate -most institutions won’t accept them.

Step 3: Apply for an ITIN

An Individual Taxpayer Identification Number is required for paying U.S. property taxes and reporting rental income.

Step 4: Choose Trusted Professionals

Work with a real estate agent, attorney, and possibly a tax advisor who has experience with foreign buyers.

Step 5: Keep Everything in One Place

Store certified translations, receipts, and your originals in a secure folder or cloud storage — they may be needed again for tax or visa purposes.

🌍 Why Non-English Speakers Choose Immi Translating Service

At Immi Translating Service, we understand the challenges that non-English speakers face when navigating international real estate.

Here’s why global clients trust us:

-

ATA-Certified Translators accepted by U.S. real estate, legal, and financial institutions

-

Real Estate Translation Experts with knowledge of title deeds, escrow terms, and contracts

-

Fast Turnaround so you never miss a deadline

-

Confidential and Secure Handling of personal and financial documents

-

Multilingual Support in over 50 languages

✈️ Thinking Long-Term? Why Some Buyers Move to America

For many foreign investors, real estate is just the first step toward a larger life goal: moving to America. Whether through family, education, or business, U.S. property ownership can serve as a foundation for:

-

Long-term stays on a visa

-

EB-5 investment visa pathways

-

Relocation for children studying abroad

-

Retirement planning

Having properly translated and certified documents from the start helps you remain compliant and organized — whether you’re staying temporarily or planning a future in the U.S.

📞 Ready to Invest in America? Start With Certified Translations

Don’t let language stand in the way of your property goals. Whether you’re buying a condo in New York, a vacation home in Florida, or an investment property in California, certified translations are a must-have for non-English speakers.

📝 Get Your Documents Translated Today

Visit www.immitranslatingservice.com.au to get your ATA-certified translation specialists. We’ll help you prepare your documents accurately, legally, and on time, so you can invest in America with no issues.